Budgeting for Small Businesses: Make Your Money Work for You 2023

Creating a budget also plays an important role in the the accounting cycle, which ensures that all financial transactions are properly accounted for. Additionally, employees should know about any changes you make that might affect them or your company so they understand what is expected of them going forward. Ontra recommended treating your time like your money and setting external deadlines later than when you think the project will realistically be done.

- Create folders and processes for anything related to your budget, so you don’t waste time looking for lost receipts or sales data.

- This free template from Template.net works in either document or spreadsheet formats.

- They might occur daily, weekly, monthly or yearly, so make sure to get as much data as you can.

- Fixed costs are the business costs that remain the same regardless of how much sales you’ve made.

- You can feed them into an automated system and get the range between which each category’s expense lies.

Whether in our personal lives or in business, we need to factor in variable expenses. One of the easiest and most accurate ways to create a budget is to review your revenue and costs for the past year and use those numbers when creating your new budget. Cho suggested revising your monthly and annual budgets regularly to get a clearer, updated picture of your business finances.

Small business budgeting templates

Our software can set up and track your budget in real time, but we also have task, risk and resource management features to control your cost and help you avoid overspending. Automated workflows add efficiency to your processes and task approval ensures that you maintain quality expectations throughout that process. In order to stick to your business budget, you need to track expenses, receipts and invoices to make sure you’re not going over your allotted budget. Software can help you track your costs in real time to make necessary adjustments to stay aligned with your budget. Creating a business budget, whichever type you need, is only the starting point. Budgetary management is the process of overseeing and tracking income and expenses throughout the year.

Duluth Mayor Emily Larson proposes ‘good news’ budget with influx … – Star Tribune

Duluth Mayor Emily Larson proposes ‘good news’ budget with influx ….

Posted: Tue, 22 Aug 2023 15:22:57 GMT [source]

Your budget should be such that you can increase your revenue and profit enough as your business expands to handle your growing expenses. Your budget should factor in fixed, variable, one-time, and unexpected costs. Some examples of a fixed expense are rent, mortgages, salaries, internet, accounting services, and insurance. Examples of variable costs include cost of goods sold and commissions for labor.

Variable Costs

For example, if you sell children’s backpacks, you might see that the back-to-school season is one of your busiest periods. You can use that information to decide if you want to hire more staff during this period, increase your marketing budget, or extend your business hours. With all of that work done, you now have something that accurately documents your business finances.

- You now know where your money is going and can make the necessary adjustments to turn a profit.

- You can easily handle tasks like projecting cash flow or estimating costs, and you can set realistic goals for your business.

- The small business budget percentages need to be accurate as they will dictate future operations.

- It’s equally important to encourage communication between related departments.

This is especially true for businesses that manufacture their own products. Sales commissions, materials costs, and labor costs are other examples of variable expenses. It’s time to talk about creating a business budget so you can take advantage of its benefits. This includes maximizing efficiency, achieving your goals and even identifying funds that can be reinvested or predicate slow months to avoid overspending.

Use Your Budget to Stay on Track

Budget data can be edited when desired, and to get a sense of your business performance, run the Budget vs. Actuals report, which displays current company performance to date. According to Scranton, businesses of all sizes experience financial fluctuations, so it’s important to plan ahead. Just because you’re the business owner doesn’t mean all the pressure lies on you.

Governor Abbott Lauds Role Of Small Businesses In Texas’ Historic … – Office of the Texas Governor

Governor Abbott Lauds Role Of Small Businesses In Texas’ Historic ….

Posted: Thu, 10 Aug 2023 07:00:00 GMT [source]

Monitoring actual business expenses is the lifeblood for your budget. Without this step, a budget is a purely theoretical document that can’t hold any real power to steer business decision-making. Collect thorough, accurate updates throughout each period to see how your intended budget performs in practice. Entrusting financial decisions to someone else is a big move!

You can also check out this simple Startup Cost Calculator from CardConnect. It lays out some of the most common expenses that you might not have considered. From there, you can customize a rough budget for your own industry.

How to make a budget for your small business

Next, subtract your total expenses from your total revenue and you’ll have either a positive number, meaning your business turned a profit, or a negative number, which is a loss. If your business is new, you’ll want to use projected costs, Business budget such as your monthly rent going forward, your expected utility bills, and so on. Not only sales that undergo mammoth level expectations, but also expense control where the projections are made keeping only cost-cutting in mind.

It can differ based on the type of business you’re in, the business stage, your target market, sales, etc. A freelance writing firm’s budget will be different from a big city restaurant’s budget. If you’re looking for a simple, easy-to-use yet impressive budget planner, budgeter is perfect for you.

Estimate your variable costs

This business template can be especially useful for small businesses that want to keep track of expenses in one, comprehensive document. Capterra offers a budget template specifically for small businesses. Then, the spreadsheet will project the month-to-month budget. You can input your actual revenue and expenses to compare, making profits and losses easy to spot.

If you need to stock up on inventory to meet demand, factor this into your cost of goods sold. Use the previous year’s sales or industry benchmarks to take a best guess at the amount of inventory you need. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Save the equivalent of three to six months of operating expenses for your emergency fund. To do this, you’ll have to start saving (and we mean really save) as soon as you can. Depending on the nature of your organization, this can be a simple or complicated process. To allocate funds for business expenses, you first need to determine your income and cash flow for the period to the best of your ability.

Ask your network what you can expect to pay for professional fees, benefits, and equipment. Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. A few thousand dollars upfront could save you thousands more in legal fees and inefficiencies later on.

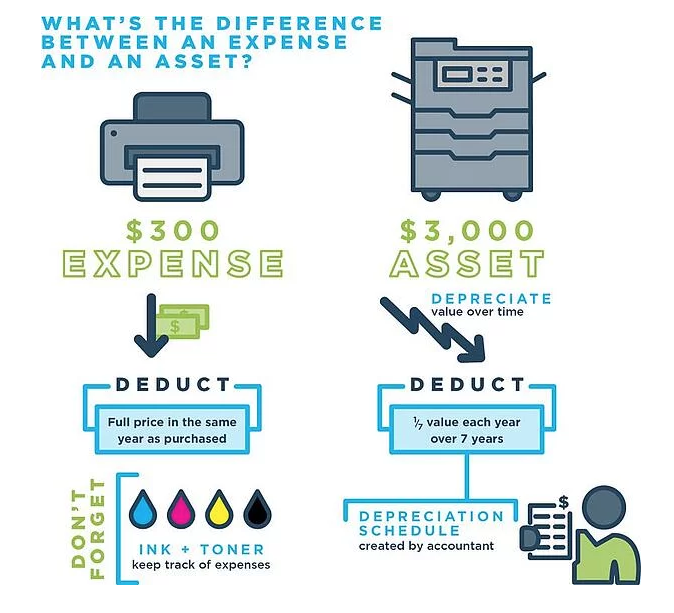

A flexible budget fluctuates with changes in sales and production. Include any expenses that remain unchanged (or fixed) throughout the period in your static budget. A business’s capital budget lays out the cost of the asset, the expected payback period, and the asset’s potential return on investment. Your capital budget can tell you whether or not the purchase would be a good investment. Your business’s financial budget can give you an overall idea of your company’s health and stability.

These include start-up costs like moving into a new office, furniture, software, equipment, and any other costs related to research and launch. These are the regular and consistent costs that don’t change according to how much revenue you earn. Things like rent, utilities, insurance, bank fees, equipment leasing, and so on. Creating a budget is the only way to determine if you are spending money the way you think you are. If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee.

Make sure it’s all considered and added to the financial plan. The basic idea behind the cash flow revelation is adding income to the opening balance while subtracting costs and expenses at different times. Should have room for feedback – Recording every step of the financial plan as it happens to see if the expenses align with the budgets and financial schedule. Is there a department or area that needs to be addressed specially and specifically?

425total visits,7visits today

425total visits,7visits today